The latest market research report from Memoori suggests that the BIoT market recovery has made a healthy recover through 2021, growing by 21% to rise above the 2019 market total, at just over $47 billion. The analysts forecast that the market will continue to grow at a healthy 12% CAGR, rising from $47.07 billion in 2021 to a forecasted $92.88 billion by 2027.

The latest information also makes the forecast that the number of connected IoT devices installed in commercial smart buildings could grow at a healthy 11.1% CAGR for the forecast period, rising from an estimated 1.264 billion in 2021 to over 2.5 billion by 2027.

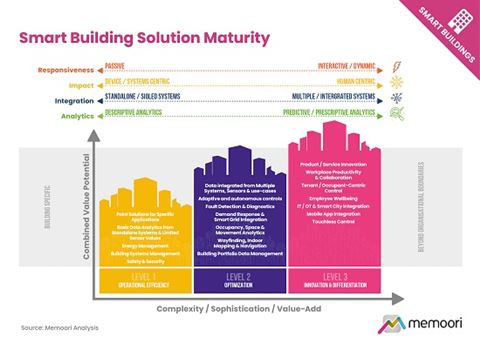

The Building Internet of Things (BIoT) market is evolving. Where previously, the focus of the market was to deliver the prerequisite technologies in the BIoT hardware stack, such as devices, sensors, and connectivity. Now, there appears to be a transition to more results-based and analytics-driven applications that seek to bring about certain outcomes.

The researchers found there is an increasing industry push towards improving the value of data generated by the BIoT through improved systems integration, as opposed to limited siloed systems. To achieve this within buildings, a layered horizontal systems architecture is increasingly being advocated for, which is technology agnostic, by using open standards, open protocols, and non-proprietary solutions.

There is an increasing industry push towards integrating building networks, systems, sensors, devices, and cloud-based software to offer a robust and secure architecture. Ensuring that all components can communicate with each other and act as a cohesive whole, instead of being limited as siloed systems. To achieve this, a layered horizontal systems architecture is increasingly being advocated for, to support delivery options in a structured way.

The BIoT digital divide

The pandemic has gone on to validate the BIoT investments of more forward-thinking building owners and operators. Effectively demonstrating the value of many previously existing BIoT solutions to deliver more resilient and efficient business operations. For example, remotely accessing building system networks and devices to monitor and configure performance during the pandemic proved challenging for those without the pre-requisite systems already in place. In many cases this led to energy being wasted on heating virtually empty buildings. Whilst office building occupancy dropped to near zero in some countries, energy use only fell by 10-15%.

Complex competitive landscape

The competitive landscape for BIoT remains incredibly complex and varied. The level of fragmentation continue to be observed in the market can act as a source of confusion and frustration for buyers, with many vendors of point solutions and platforms vying for attention. Leading platform solution providers are beginning to emerge, however, and the user base seems likely to coalesce around a more limited number of platform providers, with those unable to maintain a sustainable user base being forced to merge or withdraw from the market.

The analysts also see a greater degree of collaboration between the IT and OT worlds. A growing number of vendors are coalescing around cloud solutions provided by major IT companies such as Amazon and Microsoft. This should facilitate the development of “platform ecosystems”, where data exchange, innovation and supply chain partnering are simplified by common tools and means of data exchange.

Source: SECURITYWORLDMARKET