Many businesses have shifted fast through the COVID19 pandemic pushed by changes in people behaviour. The world has entered into uncharted waters and a deep recession. However, according to research analysts at Memoori, the good news is that these changes have given the Physical Security business some new growth opportunities, but although lock downs are now easing, and GDPs are starting to regain pace, we are still a long way from economic global recovery.

The Physical Security business has not suffered as severely as many others, partly because its products and services have been able to contribute to controlling the pandemic in buildings and the growing demand for delivering VSaaS and ACaaS. Customers, now with limited financial resources, are less likely to invest upfront in a “grudge purchase”.

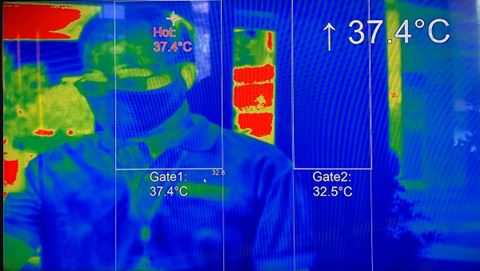

Memoori analysts suggest that COVID-19 has driven growth in “Building Wellness” systems as building operators are now in the process of installing a variety of products in preparation to meet the new standards for opening up their buildings. Demand for thermal cameras to detect the temperature of staff and visitors to their buildings has grown fast and is now a multi million dollar business.

As part of a wider tracking and testing system they can provide employees and clients with a safer environment to work in. COVID-19 has therefore directly delivered the physical security business a significant new growth opportunity. However demand has recently fallen off as some suppliers have offered their systems as “fever cameras” when in fact thermal cameras can only detect body temperature.

The drive to improve the performance of Physical Security products will not be stunted by COVID-19 in particular video analytics software developments have now proven that they can deliver such benefits to users and that they will get a return on their investment.

In this challenging economy, customers will be demanding more value from their investments and will be less willing to commit to upfront capital expenditure. This is making ACaaS and VSaaS services even more attractive.

This shifts the investment off the building’s balance sheet, as the total service eliminates upfront capital expenditure. Memoori also expects alliances and acquisitions will become more important in strategic matters as opportunities open up during the next 24 months.

The Physical Security industry now waits for Q3 financial results to find out how fast the industry will bounce back. At this time, the most optimistic scenario would be a return to pre-COVID business trading in Q2 2021 provided that the virus is contained by the end of 2020; and a proven vaccine is made available to the world by mid 2021.

Source: Security World Market